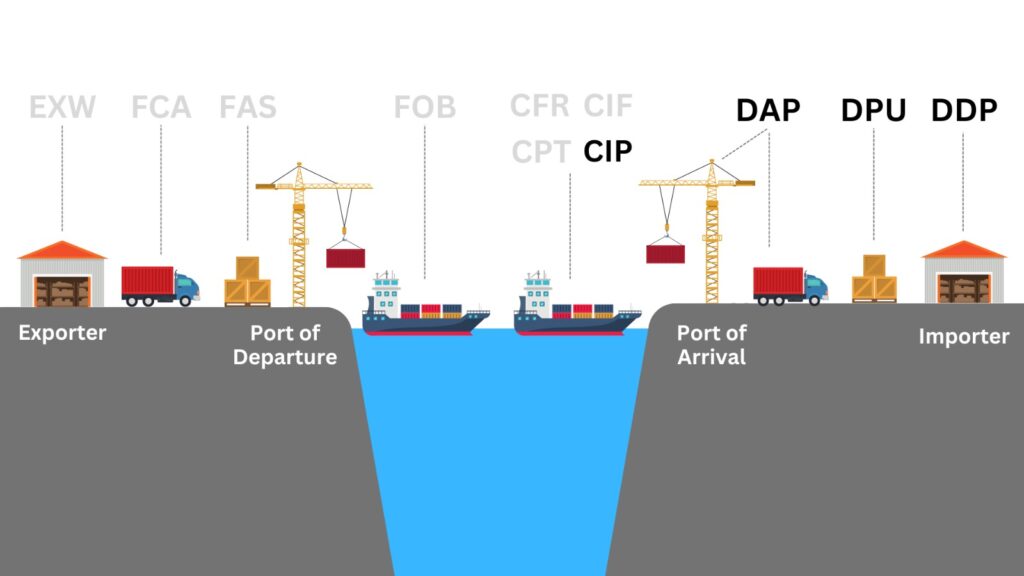

Incoterms (International Commercial Terms) are a set of globally recognized trade terms established by the International Chamber of Commerce (ICC) first published in 1936, updated and reissued in 2020. They define the responsibilities of buyers and sellers involved in the delivery of goods under sales contracts. Incoterms outline who is responsible for various aspects of international trade, such as shipping, insurance, import/export duties, and transportation costs. These terms are essential for avoiding misunderstandings and disputes in cross-border transactions.

This is the second article in a 3-part series that will explain in detail what each incoterm means, what part of the trade transaction it impacts and the relative responsibilities of buyers and sellers. In this piece we will define the next 4 incoterms under the Incoterms 2020 Rules for Any Mode of Transport – CIP, DAP, DPU and DDP.

For Incoterms EXW, FCA and FAS, please refer to Part I.

Incoterm 2020 Rules for Any Mode of Transport

4. CIP – Carriage and Insurance Paid to (named place of destination)

CIP requires the seller to insure the goods for 110% of the contract value under Institute Cargo Clauses (A) of the Institute of London Underwriters or any similar set of clauses, unless specifically agreed by both parties. The policy should be in the same currency as the contract, and should allow the buyer, the seller, and anyone else with an insurable interest in the goods to be able to make a claim.

The buyer should note that under CIP the seller is required to obtain insurance only on minimum cover. Should the buyer wish to have more insurance protection, they will need either to agree as much expressly with the seller or to make their own extra insurance arrangements.

5. DAP – Delivered At Place (named place of destination)

Incoterms 2010 defines DAP as ‘Delivered at Place’ – the seller delivers when the goods are placed at the disposal of the buyer on the arriving means of transport ready for unloading at the named place of destination. Under DAP terms, the risk passes from seller to buyer from the point of destination mentioned in the contract of delivery.

Once goods are ready for shipment, the necessary packing is carried out by the seller at their own cost, so that the goods reach their final destination safely. All necessary legal formalities in the exporting country are completed by the seller at their own cost and risk to clear the goods for export.

After the arrival of the goods in the country of destination, the customs clearance in the importing country needs to be completed by the buyer, e.g. import permit, documents required by customs, etc., including all customs duties and taxes.

Under DAP terms, all carriage expenses with any terminal expenses are paid by the seller up to the agreed destination point. The necessary unloading cost at final destination has to be borne by the buyer under DAP terms.

The seller bears all risks involved in bringing the goods to the named place.

6. DPU – Delivered At Place Unloaded (named place of destination)

This Incoterm requires that the seller delivers the goods, unloaded, at the named place of destination. The seller covers all the costs of transport (export fees, carriage, unloading from main carrier at destination port and destination port charges) and assumes all risk until arrival at the destination port or terminal.

The terminal can be a port, airport, or inland freight interchange, but must be a facility with the capability to receive the shipment. All charges after unloading (for example, import duty, taxes, customs and on-carriage) are to be borne by the buyer. However, it is important to note that any delay or demurrage charges at the terminal will generally be borne by the seller.

Some uncertainty has emerged since Incoterms 2020 were adopted as to the meaning of “unloaded” when goods are delivered in a container, usually by sea, as the removal of the container from the incoming vessel may suggest that it has been “unloaded”, but the goods themselves are not yet “unloaded” while they remain in the container.

7. DDP – Delivered Duty Paid (named place of destination)

The seller is responsible for delivering the goods to the named place in the country of the buyer, and pays all costs in bringing the goods to the destination including import duties and taxes. The seller is not responsible for unloading. This term places the maximum obligations on the seller and minimum obligations on the buyer. No risk or responsibility is transferred to the buyer until delivery of the goods at the named place of destination.

The most important consideration for DDP terms is that the seller is responsible for clearing the goods through customs in the buyer’s country, including both paying the duties and taxes, and obtaining the necessary authorizations and registrations from the authorities in that country. Unless the rules and regulations in the buyer’s country are very well understood, DDP terms can be a very big risk both in terms of delays and in unforeseen extra costs, and should be used with caution.

iTradeDigital is simplifying international trade for businesses of all sizes, everywhere – by digitising and automating the flow of the documentation required for cross-border trade. Contact us to learn more about how we can help you simplify international trade and open up new revenue opportunities for your business or simply register online to get started.

– ##### –

Authors:

John Dunlop is a trade finance expert with over thirty years of experience in managing letter of credit and collection transactions from purchase order to final payment. Previously CEO of InterNetLC.com and is currently a Team Leader at iTradeDigital IOM Ltd.

Tony Kavanagh is a technology executive with over 25 years of experience in building brands and driving demand for companies of all sizes, globally. Skilled in GTM strategy, product marketing, PR/AR and CRM success, Tony has held senior positions at KPMG, Oracle, Salesforce, DataStax, Insightly, & XOJET. He is currently CMO at iTradeDigital IOM Ltd.

– ##### –